What is Know-Risk?

Know-Risk™ is a subscription-based service. If you would like more information, contact FCStone at 312.373.8250 or email [email protected].

The Know-Risk™ online tracking and reporting system is a medium for physical and financial deal capture, credit risk management, market risk management, and report generation.

Initial & Ongoing Data Input

- Products and Positions

- Counterparty Information

- Forward Price Curves and Volatilities

Price & Credit Risk Tracking

- Price and Credit Risk Exposure Tracked Daily

Hedge Plan Functionalities

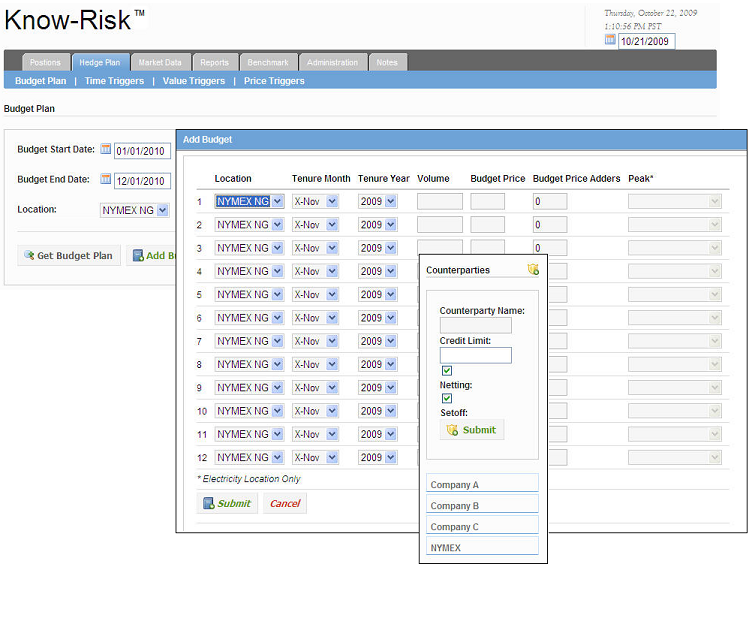

- Customized Budgets

- Price and Time Trigger Tracking

- Tool Options

Counterparty Credit Strength Review

- Scoring Methodology Review

- Current and Prospective Counterparty Evaluation

Reports & Risk Metrics

- Mark-to-Market/Net Positions

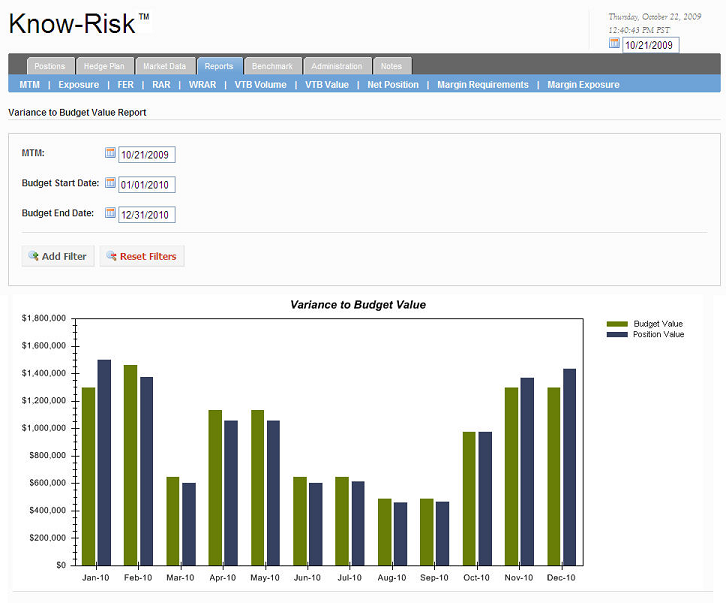

- Variance to Budget Volume/Value

- Current & Forward Credit Exposure

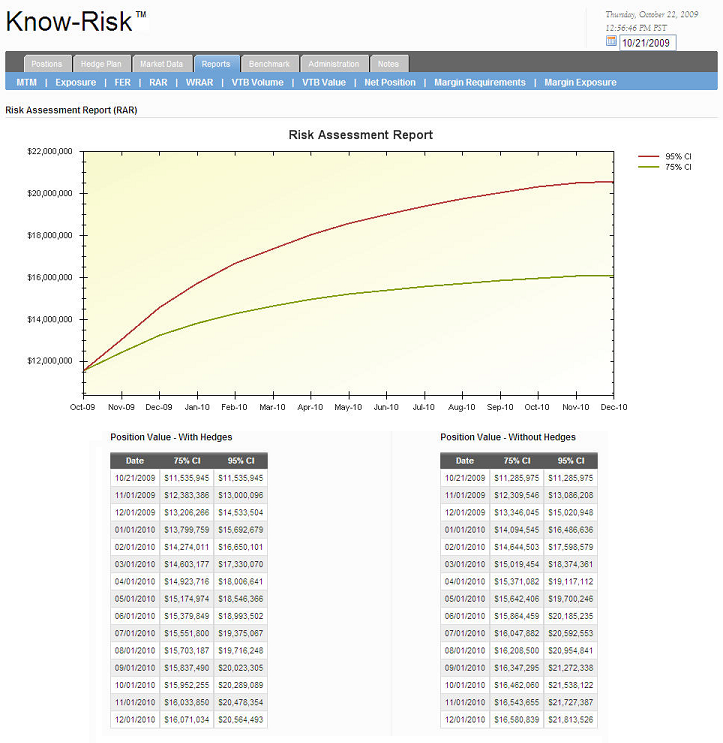

- Risk Assessment Calculations

- Stress Test Analysis

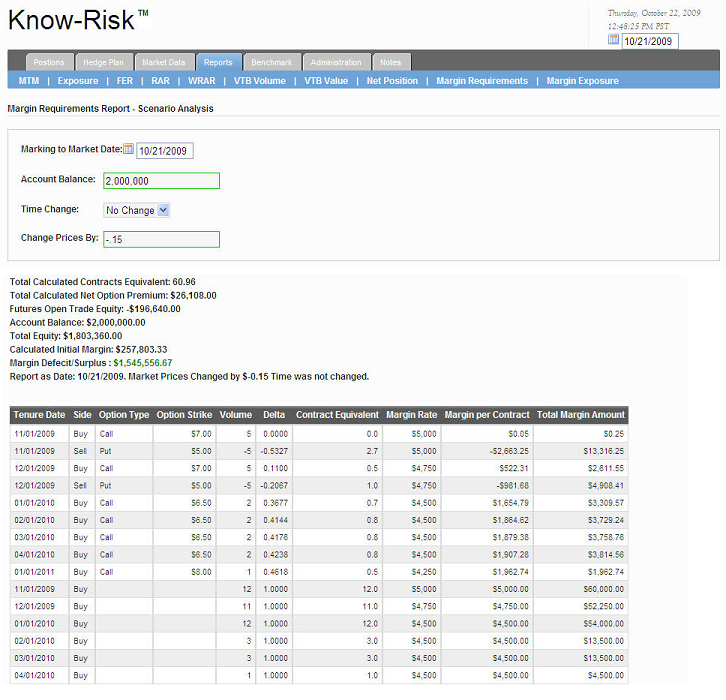

- Margin Requirements/Exposure

- Benchmarking

All budget, position, and counterparty data is entered into the Know-Risk™ tracking system. Prices for marking positions to market feed in directly through Mark-It View™.

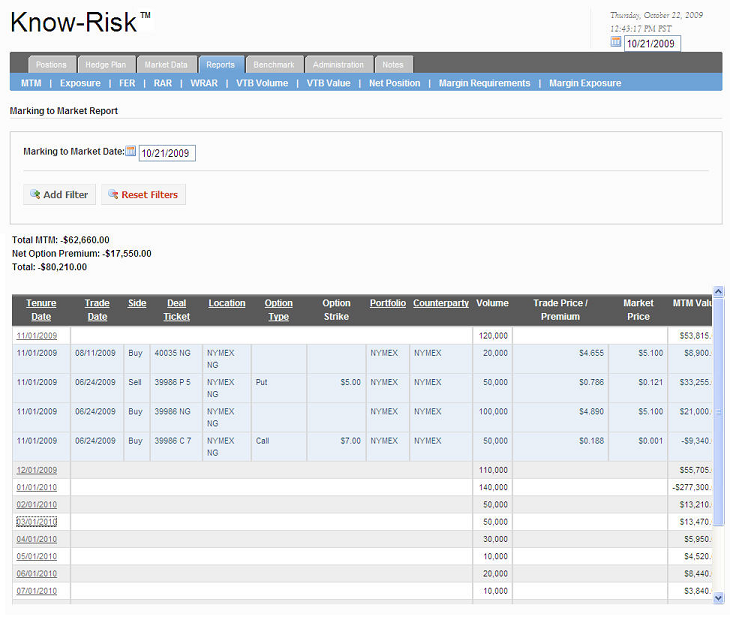

The Mark-to-Market report compares all initiated positions to current market prices to determine profit and loss for a given portfolio.

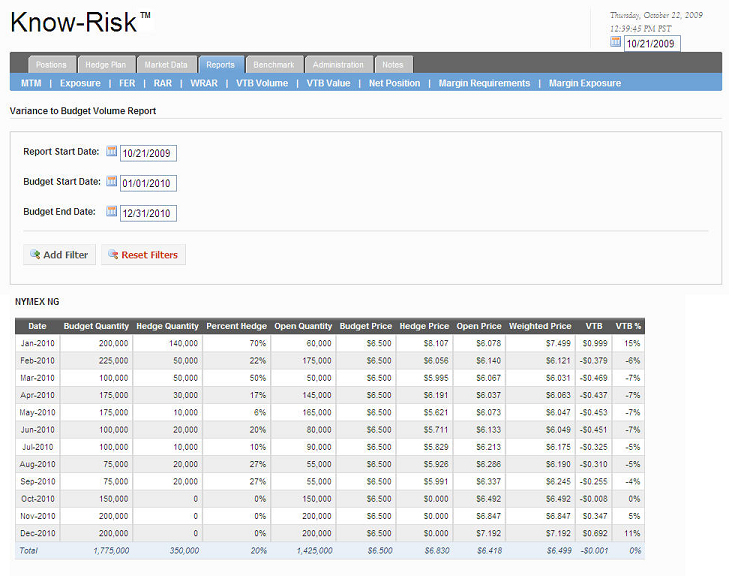

The Variance-to-Budget Volume report captures both hedged and unhedged volumes to calculate the portfolio’s current value and compares it to a previously set budget number.

The Margin Requirements report provides an estimate of open trade equity, total equity, initial margin requirement, and margin deficit/surplus.